Small business journalist Ben Lobel reports

that the average UK SME is owed £11,358 in unpaid invoices, while one in five

SMEs are owed more than £30,000. The total amount of money owed to all the SMEs

in the UK is more than £55

billion.

Small business journalist Ben Lobel reports

that the average UK SME is owed £11,358 in unpaid invoices, while one in five

SMEs are owed more than £30,000. The total amount of money owed to all the SMEs

in the UK is more than £55

billion.

When your company started out, you probably didn’t intend to

become a creditor to other businesses who fail to pay invoices on time. So who

owes your small business money, and how can you get what you’re owed?

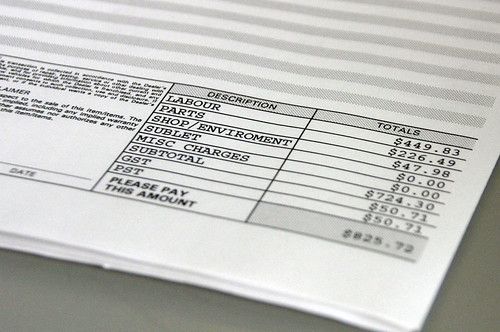

Invoice and Follow Up

Every business, even the smallest, needs a solid process for

invoicing, following-up and making sure you get paid.

Consider sending invoices digitally rather than sending

paper in the mail. A digital invoice can include an instant payment link that

lets the recipient pay the invoice online immediately, instead of adding it to

a to-do list that never gets done. And the sooner that payment is made, the

easier your business’ cash flow will be.

Another benefit of invoicing digitally is that it’s easy to

set up email reminders for late invoices. That will save you time and energy

compared to going through a list once a week or once a month to follow up. And

the range of cloud computing options for accounting and invoicing is

impressive.

Chase Late and Unpaid Invoices

If your client or customer fails to pay an invoice within a

reasonable time, email reminders may not be enough to prompt them into action.

Pick up the phone and ask them directly to tell you when they’ll make their

payment.

If you can’t reach your debtor by phone, send a letter

reminding them of the invoice and explaining that this will be your last

attempt to prompt them to pay before you get outside assistance to claim the

amount due. In the worst case scenario, you may have to use the courts system

to claim the money your business is owed.

Be aware and worried about the payment of your invoices that these must be paid and received on time. These are the important factors in businesses. I really appreciate the writer for sharing this worthy article with us and you need to get best essay writing services 2018 which will helpful to learn each point.

ReplyDelete